Introducing manual application

Manual application lets you apply bank statement lines to open ledger entries when automatic matching cannot identify the correct entries. It gives you full control over which invoices, payments, or transactions to apply to a bank statement line.

Tip

Always run automatic matching first because it handles most scenarios efficiently. Use manual application only when automatic matching cannot identify or process the correct entries..

Manual application is part of the Continia Banking Import module. You can use it in both the Bank Account Reconciliation and Payment Reconciliation Journal pages. Manual applications are fully integrated with the Payment Application Review workflow and appear as proposals with Found By set to Manual Application.

Use manual application when:

- Automatic matching cannot identify the correct ledger entry.

- A bank statement line must be applied to multiple ledger entries, including entries of different account types.

- Only part of the bank statement amount should be applied.

- An existing application needs correction.

Prerequisites

Before applying ledger entries manually, make sure that bank statement lines are imported (manually or automatically) and open ledger entries exist.

Required setup:

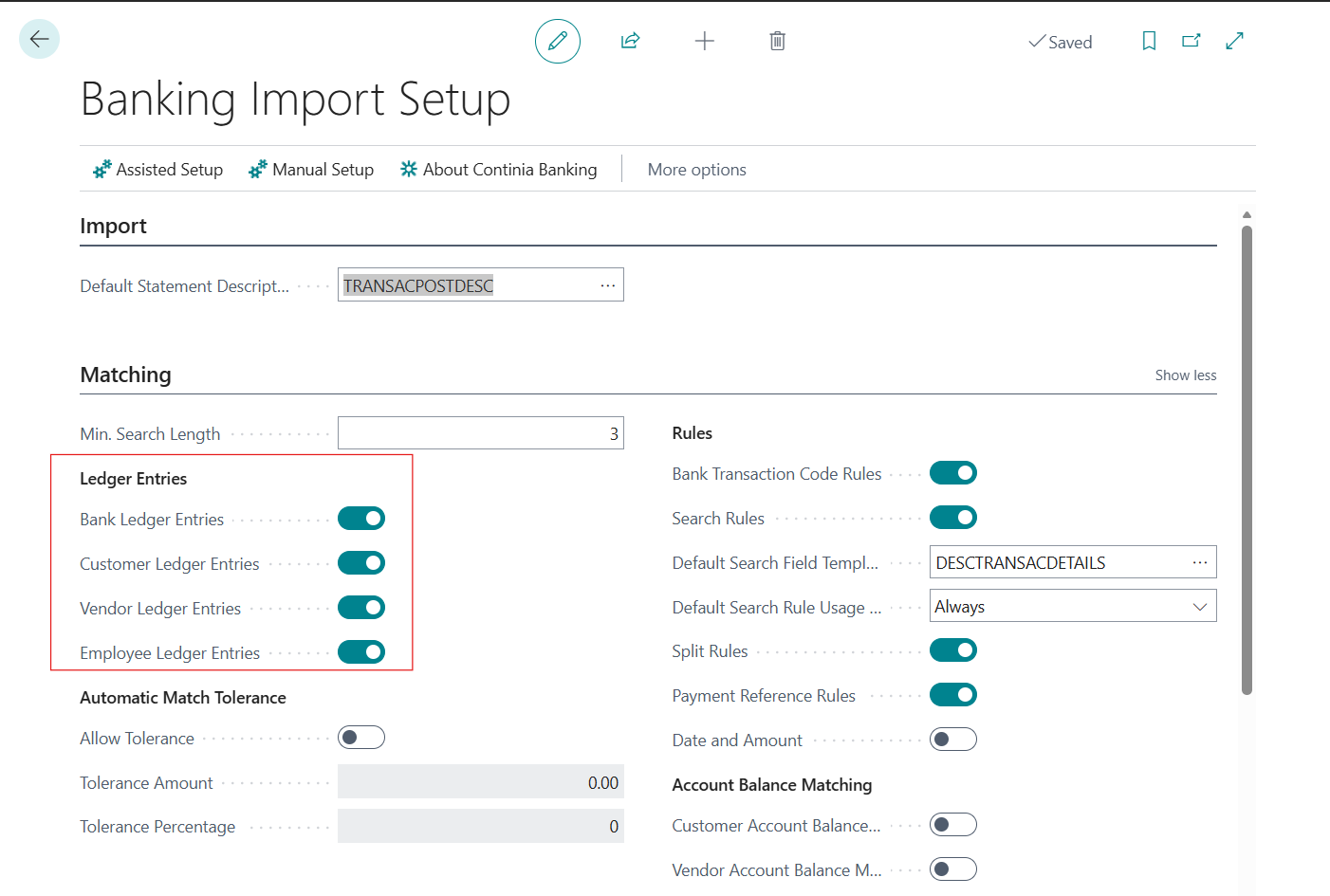

- Activate Continia Banking for the bank account.

- Configure the Banking Import Setup to enable matching for the entry types you need. You can enable matching for bank account, customer, vendor, and employee entries. If you use Continia Finance and the G/L Open Entries module, you can also enable matching for G/L open entries.

Important

If an entry type is disabled in Banking Import Setup, it does not appear on the Apply Ledger Entries page.

Optional setup:

- On the General Ledger Setup page, configure Payment Tolerance % and Max. Pmt. Tolerance Amount.

- On the Sales & Receivables Setup page, use Appln. Between Currencies to determine whether customer payments can be applied across currencies.

- On the Purchase and Payables Setup, use Appln. Between Currencies to determine whether vendor payments can be applied across currencies.

For more information, see Applying ledger entries manually.

The process

When you apply entries manually, the system:

- Creates a payment application proposal and sets the Found By status to Manual Application.

- Stores the applied amount, discount, and tolerance.

- Links the bank statement line to the ledger entry.

- Shows the proposal on the Payment Application Review page.

- Creates the applied payment entry used during reconciliation posting to apply actual ledger entries.

- Creates journal lines (Bank Account Reconciliation only):

- Customer entries in the Cash Receipt Journal.

- Vendor/Employee entries in the Payment Journal.

- G/L account entries in the General Journal.

- Bank-to-bank applications without journal lines.

- Matches bank account ledger entry (if applicable), links bank ledger entry to the reconciliation line and enables automatic application when the journal is posted.

- Updates the reconciliation status:

- Completed when no difference remains.

- Difference when a difference remains.

Note

You can review created journal lines before posting by choosing Cash Receipt Journal, Payment Journal, or General Journal from the reconciliation page.

Payment discounts and tolerances

When you apply ledger entries manually, Continia Banking can automatically apply payment discounts and small amount differences based on your setup. If a ledger entry includes a payment discount and the bank transaction meets the discount conditions, the system applies the reduced payment amount and the discount together.

If the payment date falls just outside the discount period, discount tolerance can still allow the discount within the tolerance window. Payment tolerance handles small remaining amounts such as rounding or minor fees.

Multi-currency applications

When applying entries in different currencies, Continia Banking automatically handles currency conversion:

- Entry Currency is the currency of the ledger entry.

- Application Currency (Appln. Currency) is the currency of the bank statement or Local Currency (LCY).

- Exchange rates are retrieved based on the transaction date.

- All amounts appear in both currencies when you choose Show More Columns.

When working with multi-currency applications, use the Show More Columns to view additional fields:

| Field | Description |

|---|---|

| Currency Code | Currency of the ledger entry |

| Appln. Currency | Currency used for the application |

| Appln. Applied Amount | Applied amount converted to application currency |

| Appln. Remaining Amount | Remaining amount converted to application currency |

| Rounding | Rounding difference from currency conversion |

For example, euro bank account and USD invoice:

- Bank statement line: €980 EUR

- Customer invoice: $1,050 USD

- Exchange rate on transaction date: 1 EUR = 1.07 USD

- Converted invoice amount: €981.31 EUR

- Application: €980.00 applied + €1.31 difference

- The Rounding field shows the €1.31 difference caused by currency conversion and exchange rate fluctuations.

Tip

Review the Rounding field during multi-currency application. Large differences can indicate incorrect exchange rates or timing issues.

Related information

Applying ledger entries manually

Manual application examples

Manual application FAQ

The Apply Ledger Entries page