Setting up a payment reference rule

You can use payment reference rules in Continia Banking to automatically reconcile payment references such as FIK, SCOR, and Swiss QR. These default rules identify references in the document number or payment reference fields. You can also create your own rules to match imported bank statement lines with open ledger entries.

Setting up a payment reference rule helps ensure accuracy and consistency in financial records by defining how references are validated, matched, and processed.

Key considerations

- Mandatory fields - fields marked with a red asterisk (*) must be completed to prevent errors.

- Notifications - if any settings are missing or incorrect, notifications will appear in the Bank Acc. Reconciliation or Payment Reconciliation Journal, helping you quickly identify and address issues. Also, see Payment reference rules FAQ

- Don't change default rules - default rules can't be deleted, only disabled. To [customize a default rule, click Copy.

- Always test a rule - before using a payment reference rule in production, verify that it correctly matches and processes references. You can test the rule on the Test FastTab.

To access payment reference rules

To access payment reference rules:

On the Banking Import Setup page, on the action bar, select Manual Setup and then select Payment Reference Rules. Alternatively, search (

) for and select Payment Reference Rules.

) for and select Payment Reference Rules.On the Payment Reference Rules page, you can view and download predefined rules. Continia Banking provides rules for FIK71, FIK71-PREFIX, QR, and SCOR by default.

Note

Additional payment reference rules will be introduced in future updates.

Click a rule to view its configuration. For more information about the different FastTabs and fields, refer to the To set up payment reference rules section of this article.

To set up payment reference rules

By setting up payment reference rules, you can define how payment references are validated, matched, and processed within your system.

To set up a payment reference rule:

Search (

) for and select Payment Reference Rules. Alternatively, go to the Payment Reconciliation Journal or Bank Account Reconciliation page, and on the Rules tab, select Payment Reference Rules.

) for and select Payment Reference Rules. Alternatively, go to the Payment Reconciliation Journal or Bank Account Reconciliation page, and on the Rules tab, select Payment Reference Rules.On the Payment Reference Rules page, on the action bar, click New to create a new payment reference rule. Alternatively, click Copy Payment Reference Rule to use a default or previously set rule as a template. You cannot edit existing payment reference rules directly. These rules are managed by the system, and any changes you make will be overwritten. If you try to edit one, you'll see a error message that proposes you to copy the rule by selecting Copy Payment Reference Rule.

You can now configure the rule fields. Make sure to complete the fields marked with an asterisk:

- Code - enter a unique code.

- Payment Reference Search Field Template - specify where the reference appears in the bank statement. For details, see Using templates in Banking Import.

- Validation Pattern Code - use a regular expression to define the reference format. For details, see Regular expression structure for matching payment references.

- Match to Table - select the table (by caption name) in Business Central to match against.

- Match to Field - select the field to match against.

Configure optional matching settings:

Direct Match - enable to match the entire reference. Direct Match lets payment reference rules match the entire payment reference from a bank statement directly to a field in Business Central, without extracting a substring. Use it when references are consistent, such as invoice numbers, customer numbers, or external document numbers. When enabled,

Reference Start PositionandReference Lengthare ignored, but validation patterns and check digit algorithms can still apply. Always test the rule to ensure exact matches and consider substring extraction for references with prefixes, suffixes, or embedded information. See Understanding exact matching using direct match for more information.Match Document Type - Document type matching lets you extract indicators from payment references to identify the type of document (e.g., invoice, credit memo) in Business Central. Enable Match Document Type in a Payment Reference Rule and set the start position and length of the indicator. Create Document Type Mappings to link extracted codes (like "INV" or "CM") to BC document types. The system uses these mappings during reconciliation, leaving the document type blank if no mapping exists. Always link at least one mapping and test the rule to ensure accurate extraction and matching. For more information, see Working with document type matching.

Reference Start Position/Reference Length - reference positions let you extract a specific part of a payment reference for matching in Business Central, useful when references include extra characters, prefixes, or structured information. Set Reference Start Position and Reference Length in the payment reference rule to define which substring to extract. These fields are mandatory when Direct Match is disabled, and the system uses them to isolate the relevant portion for matching. Validation patterns and check digit algorithms can still be applied to the extracted substring. Always verify start position and length, and test the rule to ensure accurate extraction and matching. For more information, see Working with reference positions

Check Digit - enable to validate using a check digit algorithm. Configure the algorithm and parameters. For more information, see Configuring check digit validation.

Disabled - select to temporarily disable the rule.

Statement Type - on the Rule Filter FastTab, set filters to control when a payment reference rule is applied. You can filter by statement type (for example, CAMT.054), bank code, or bank account number. While default settings often suffice, filters help ensure that rules apply only to relevant transactions. More specific filters take precedence when multiple rules match. Use filters to avoid rule conflicts and improve matching accuracy across banks, accounts, and statement types.

To test a payment reference rule

Before using a payment reference rule in production, always test it to confirm that it matches and processes references correctly. You can do this on the Test FastTab.

If the rule doesn't behave as expected, review the validation pattern, check digit settings, and extraction positions.

To test a payment reference rule:

- Open the rule for editing. On the Test FastTab, enter a sample payment reference in the Test Text field.

- Click Test action to run the validation.

- Review the test results. The system will display results with colored indicators:

- Green text - valid results. The reference matches the validation pattern and passes all enabled validations (check digit, length, etc.).

- Red text – invalid results. The reference fails one or more validations.

- Adjust and retest. Modify the rule configuration or test text as needed. Click the Test action again to view updated results.

Note

Test results only update when you click Test—not automatically when you change fields.

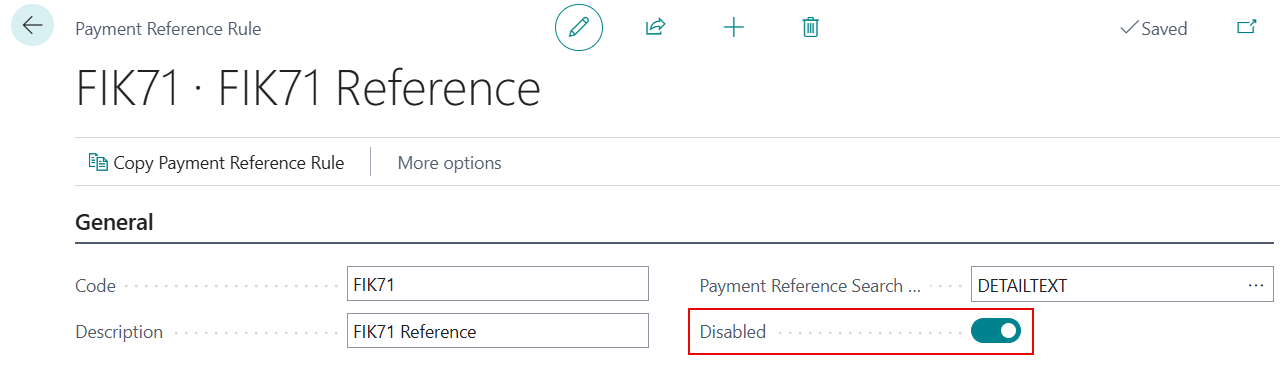

To disable a payment reference rule

To disable a payment reference rule:

- On the Payment Reference Rules page, open the page of the default rule you want to disable.

- Select the Disabled checkbox.

Disabled rules remain in the system but aren’t used during statement import.

Related information

Validation pattern codes for matching payment references

Default payment reference rules

Configuring check digit validation

Payment reference rule examples

Payment reference rules FAQ

Working with reference positions

Understanding document type matching

Understanding exact matching using direct match