Using Cash Advance

You can use the expense type, Cash Advance, or the payment type, Corporate Cash for reporting and managing cash advances and cash withdrawals from company credit cards. In providing an option for cash advance or corporate cash, this feature reduces expense reporting errors and ensures better compliance with your company's policies.

Using cash advance in the Expense Mobile App or Portal

You can submit an expense using both expense types and payment types for cash advance.

To submit an expense:

- Tap or click New Expense.

- In the Amount field, enter the cash amount, (for example, $1000. The currency will automatically be detected by your location).

- For Payment Type, tap or click Corporate Cash.

- For Expense Type, tap or click Cash advance.

- In Description, describe the expense, (for example "Cash advance for miscellaneous expenses").

- If you are using the Expense Mobile App, slide Submit, to send the report.

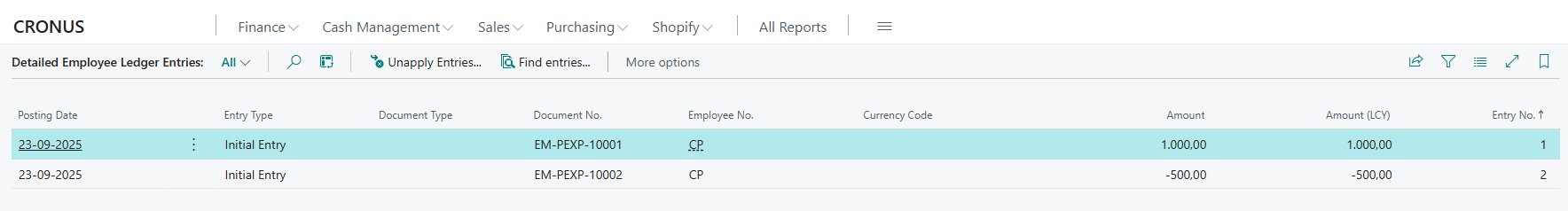

When posted, the sum of the cash (for example $1000) shows in the Amount column of your company's Detailed Employee Ledger Entries. From this point onwards, every time you spend from that original sum and create an expense with the payment type Cash, the sum in the Amount column will reduce. The following example shows the Cash expense type of $500 being deducted from the original Cash Advance amount of $1000.

Related information

For more information about expense reports, see:

Setting up pre-approval of expense reports

Setting up expense reports

Overview of expense reports

Submitting and managing expense reports